Business owners and marketers need to consider new markets for a variety of reasons. Commonly, businesses evaluate new markets when they’re looking to expand or grow. This growth might include launching new products or taking existing products to new audiences.

With Semrush .Trends, you can gather the information you need to make the best decisions. Let’s take a step-by-step look at how to use .Trends to evaluate a new market.

1. Define the market

To begin your market evaluation, you’ll need to make some decisions about how to define your market. Are you planning on looking at an entire industry globally? Or do you want to get specific and look at a particular niche in a particular geographic location? The .Trends tools can help no matter where you’re starting.

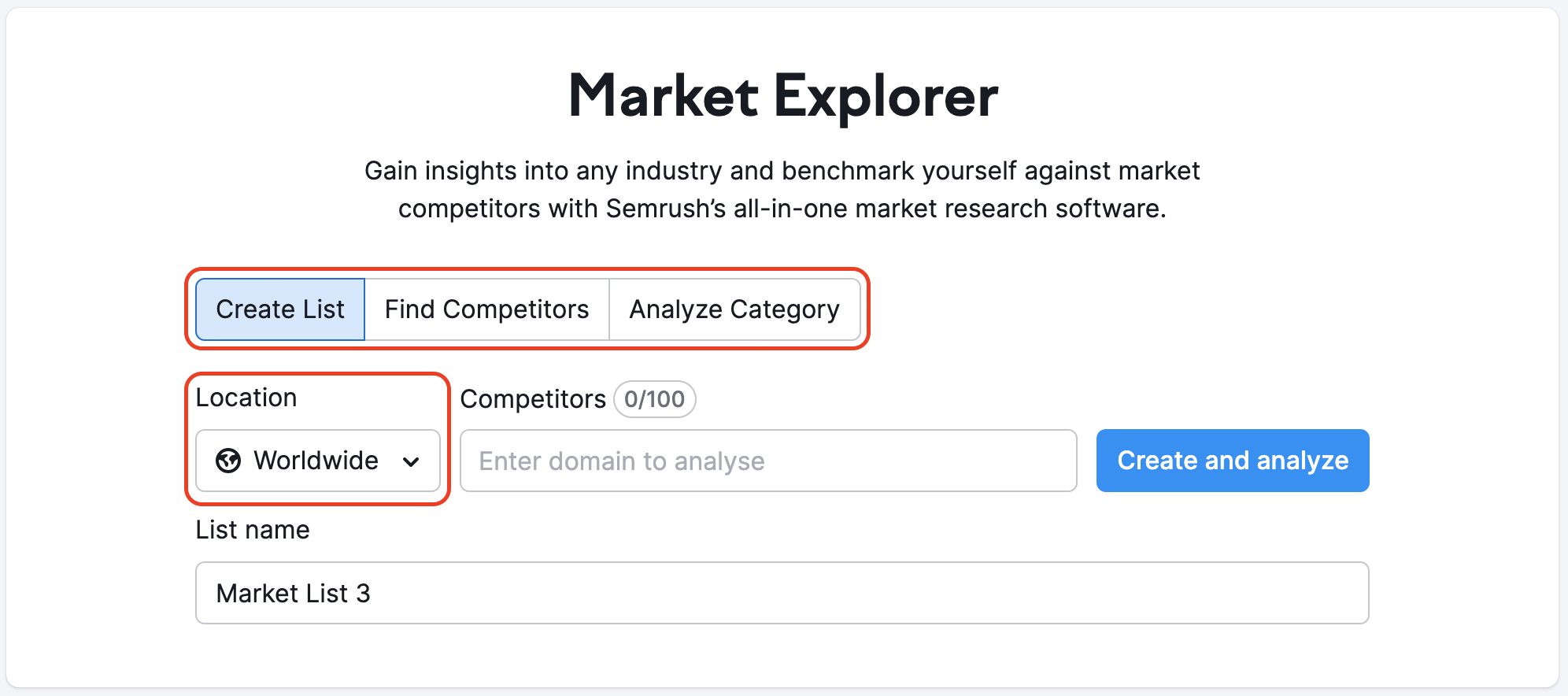

Beginning with Market Explorer, set the criteria for the market you want to evaluate. You have three options:

- Create List – This option allows you to enter a list of up to 100 competitors. It’s useful if you know who the major market players are and want to get a detailed understanding of a particular market or niche.

- Find Competitors – This option can help you find the most relevant competitors based on a specific domain. If you have a market player in mind but need help identifying additional players, this can be a great option.

- Analyze Category – This option allows you to evaluate an entire industry based on a large number of domains. If you’re looking for a true industry or market overview, this option is a good starting point.

You’ll also need to define the Location on which you’d like to focus your efforts. The Worldwide option gathers data from across the globe, while a specific country or region allows you to look at market conditions in specific locales.

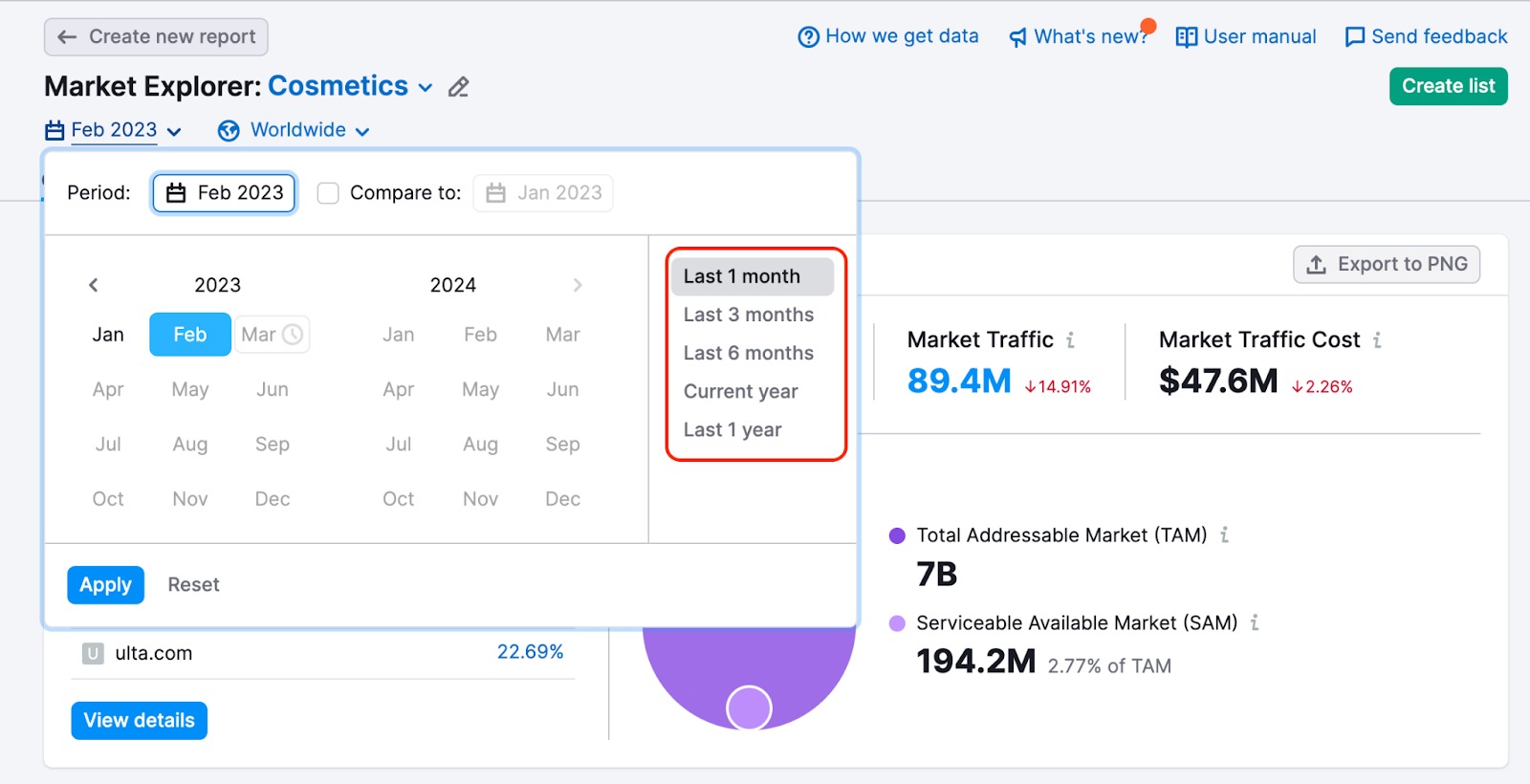

Once you define your market, the tool will bring you to the Overview Report. Select a date range for the data you’d like to view, and choose a custom data period to view market changes across time.

Working with different date ranges can reveal interesting information about changes within the market. Likewise, comparing locations can help you identify unique characteristics and opportunities among various markets.

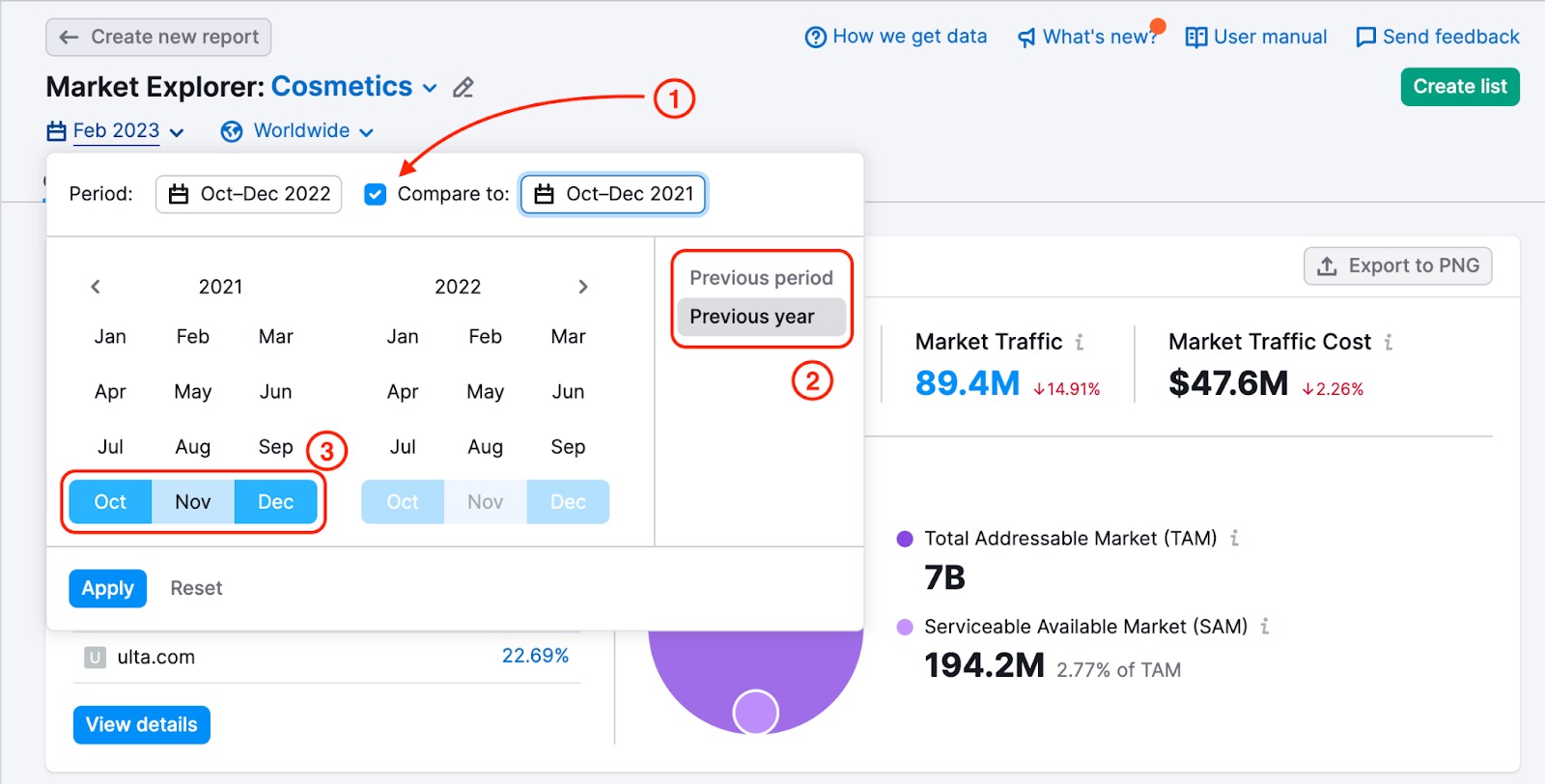

There’s an option to compare data using custom periods – for two individual months or two periods of up to 12 months. The ability to compare custom periods makes it easy to analyze seasonal dynamics and identify market trends that are difficult to spot early.

In order to see data for a custom period, you need to set the date range, check the “compare to” checkbox (1), and select the second date range – you can choose to compare to the “previous period” or “previous year” (2) or set the period manually (3).

In the widgets, you will see data for the periods you’re comparing.

2. Summarize the market’s main metrics

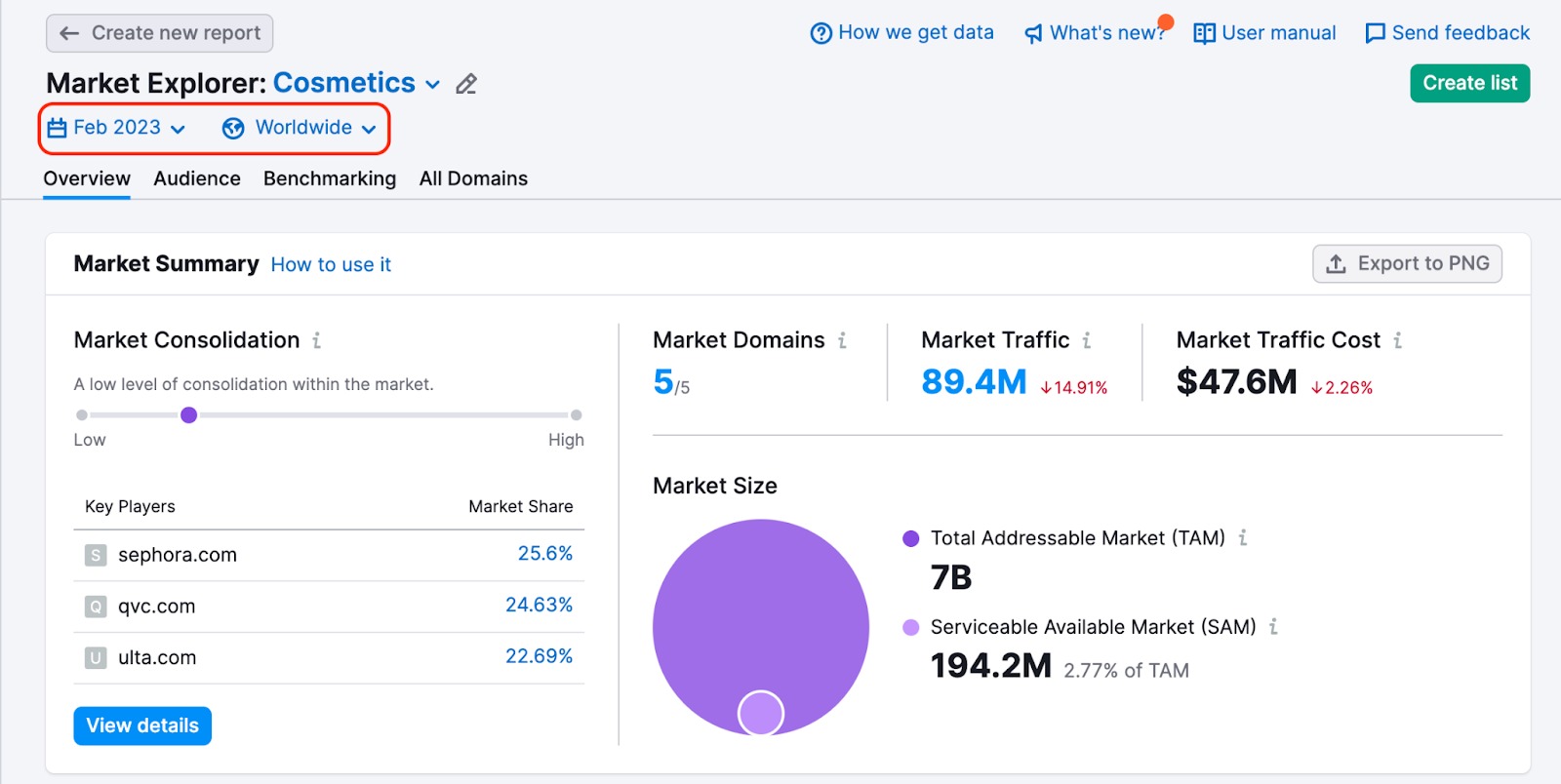

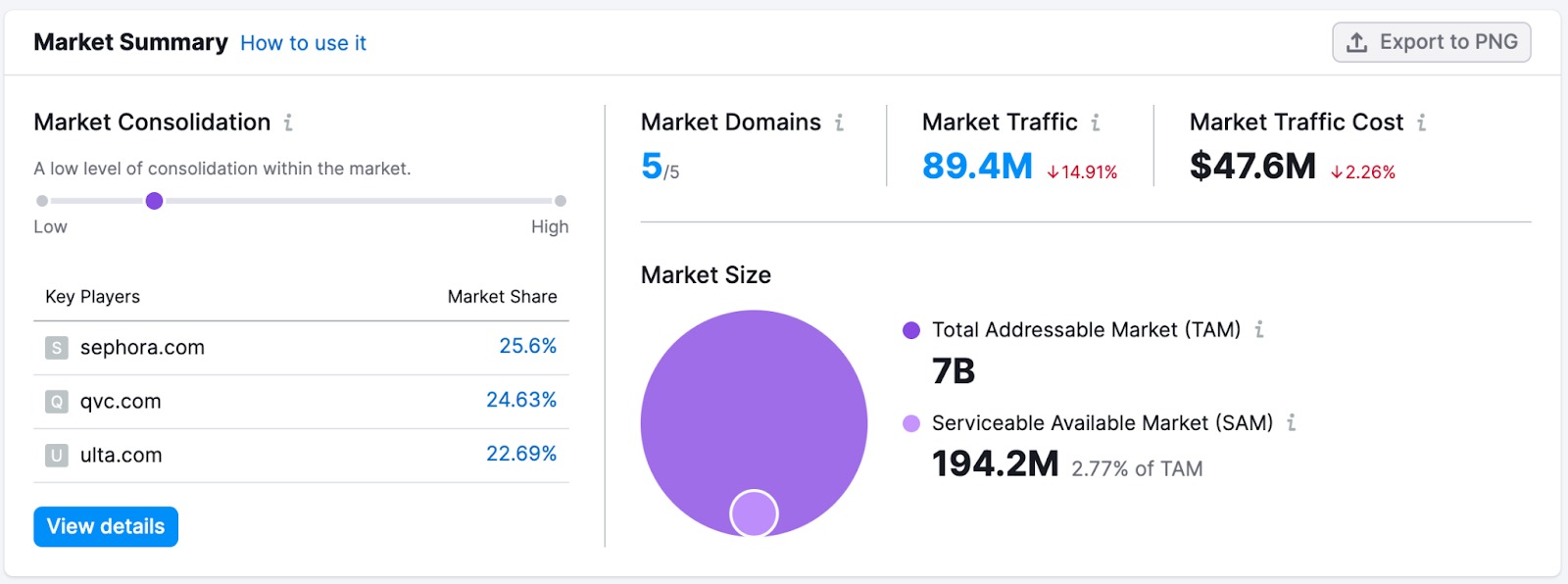

The first section of the Overview Report is called the Market Summary. Here, you’ll discover data that can help you do a general assessment of the market at a glance.

The Market Summary provides 6 key data points:

- Market Consolidation

- Key Players

- Market Domains

- Market Traffic & Traffic Growth

- Market Traffic Cost & Cost Growth

- Market Size

Taking these metrics into consideration can help you evaluate potential market growth, potential threats or opportunities, difficulty and cost of market entry, and more. It’s a great place to begin for an overall sense of the market.

For example, the Cosmetics market has a low consolidation level, meaning market entry may not be a challenge. The top three players are Ulta.com (7% market share), qvc.com (7% market share), and sephora.com (5% market share). Market traffic was on the rise with a 4% increase in December 2022 to 418M. And the market is large with a Total Addressable Market of 1.1B and a Serviceable Addressable Market of 494.5M, meaning there’s still room for growth.

3. Map the competitive landscape

After exploring the general overview of the market, begin to get a sense of the competitive landscape. Identifying the players leading the market, those that may change the game, and those still trying to find their footing. These details can offer invaluable insights about how to enter the market and position yourself successfully.

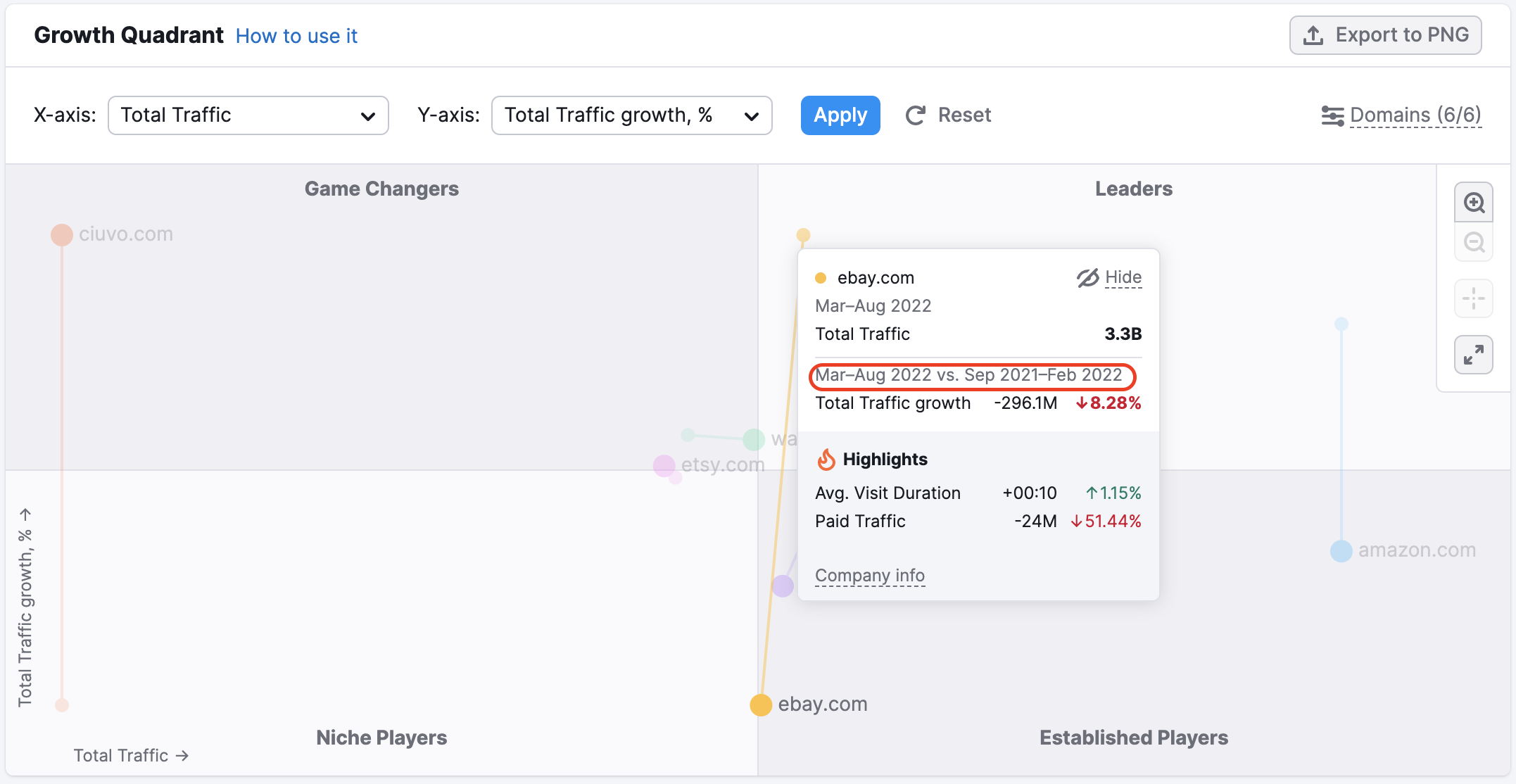

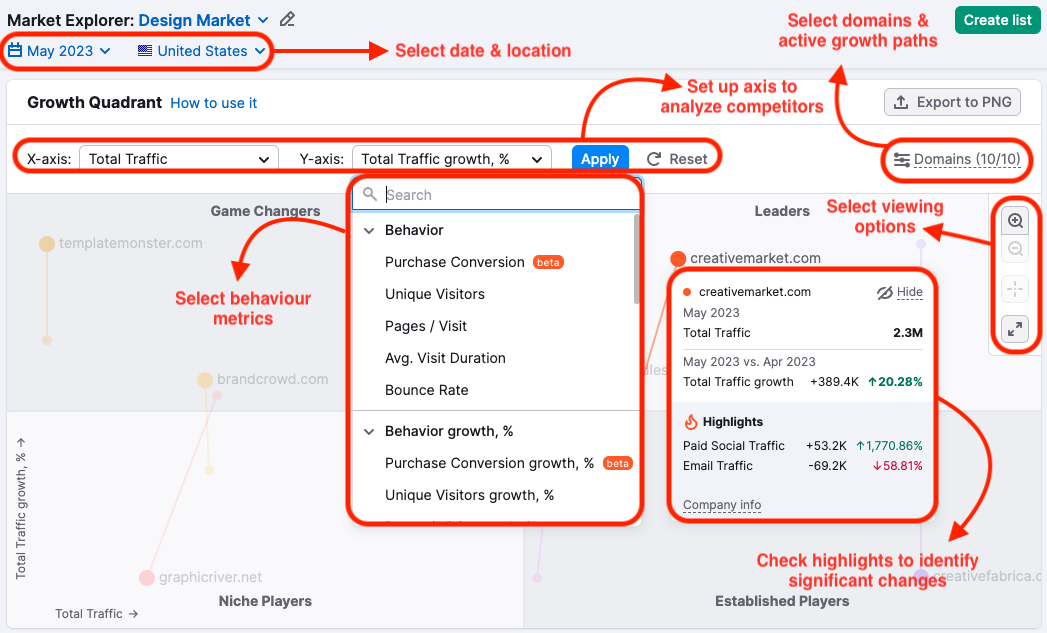

The Growth Quadrant, also found in the Market Explorer Overview Report, offers a layout of the competitive playing field that can include up to 100 domains. You have the option to customize your view in a few different ways:

- By changing the time period and location

- By turning “Growth Paths” on to view market players’ growth across the selected period of time

- By setting up axes to analyze competitors from different perspectives (for example, to analyze traffic quality set axis to Total Traffic and Bounce Rate; to analyze audience engagement set axis to Total traffic and Avg. Visit Duration)

- By revealing or hiding certain players on the matrix

- By viewing in full-screen mode or zooming in or out

The Growth Quadrant offers insights into which players have shown an increase or decrease in traffic over time. Likewise, the players’ positions across the different quadrants can help you think about their role in the market and how they might relate to your business.

To view a specific niche within the broader market, select players from the sidebar that fits squarely into that niche.

4. Explore market traffic and traffic generation strategies

Now that you’ve taken a look at the playing field, look at the main players’ traffic generation strategies and the overall market traffic trend.

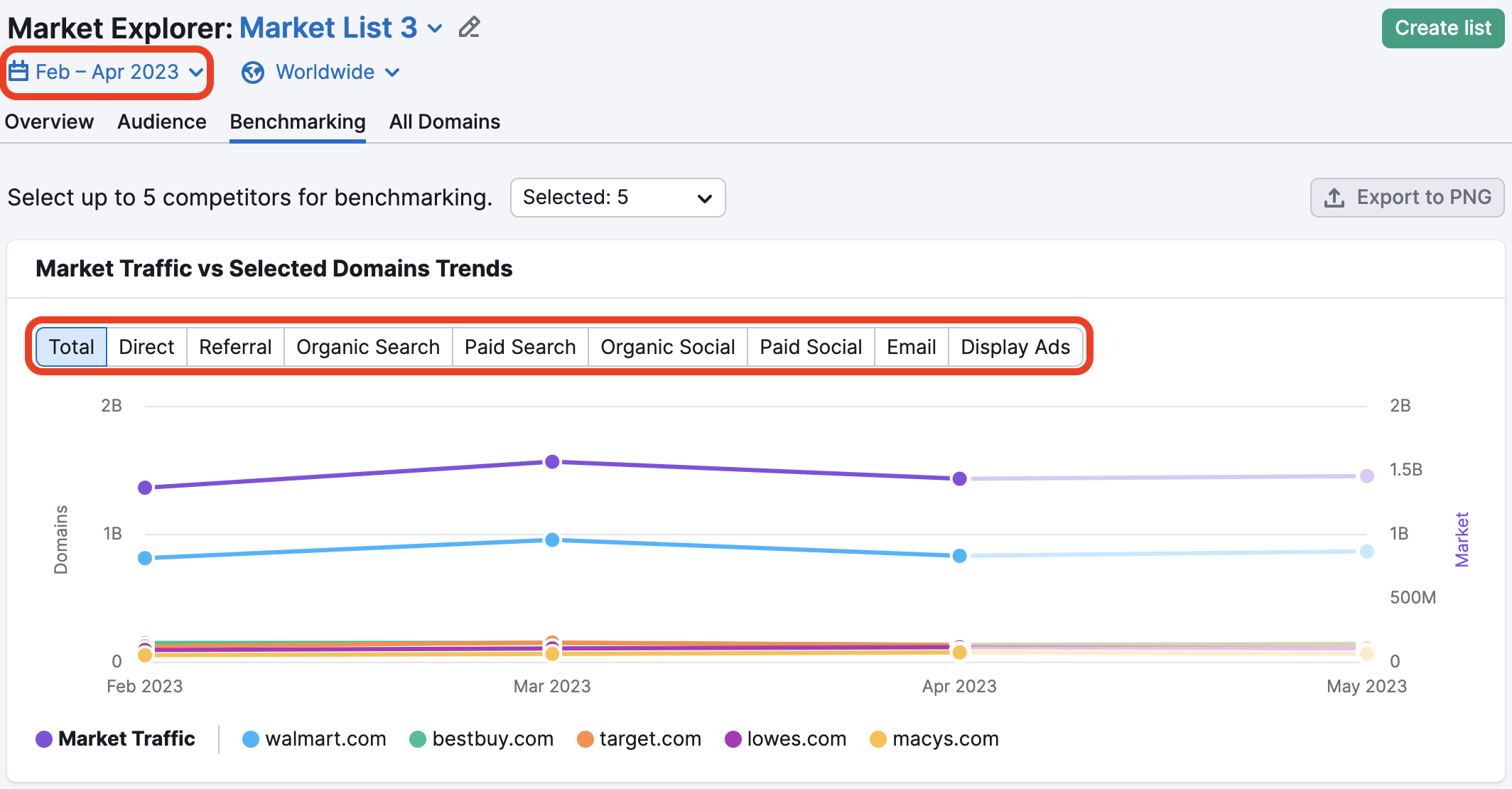

Market traffic trends can help you understand how market players attract customers. Using Market Explorer Benchmarking Report, you can view traffic trends for the top players and compare them against the overall market traffic.

First, take a look at the Market Traffic vs Selected Domains Trends graph. This graph shows traffic trends over time. Select the traffic type and the date range using the filters at the top of the graph.

Comparing the trends for individual players to the overall trend can reveal interesting insights. For example, the Cosmetics market saw a boost in traffic in March 2022. Looking at the trend for the individual players, however, it looks like ulta.com was the only competitor that saw a similar boost. With this information, we might drill down further to see what inspired the spike.

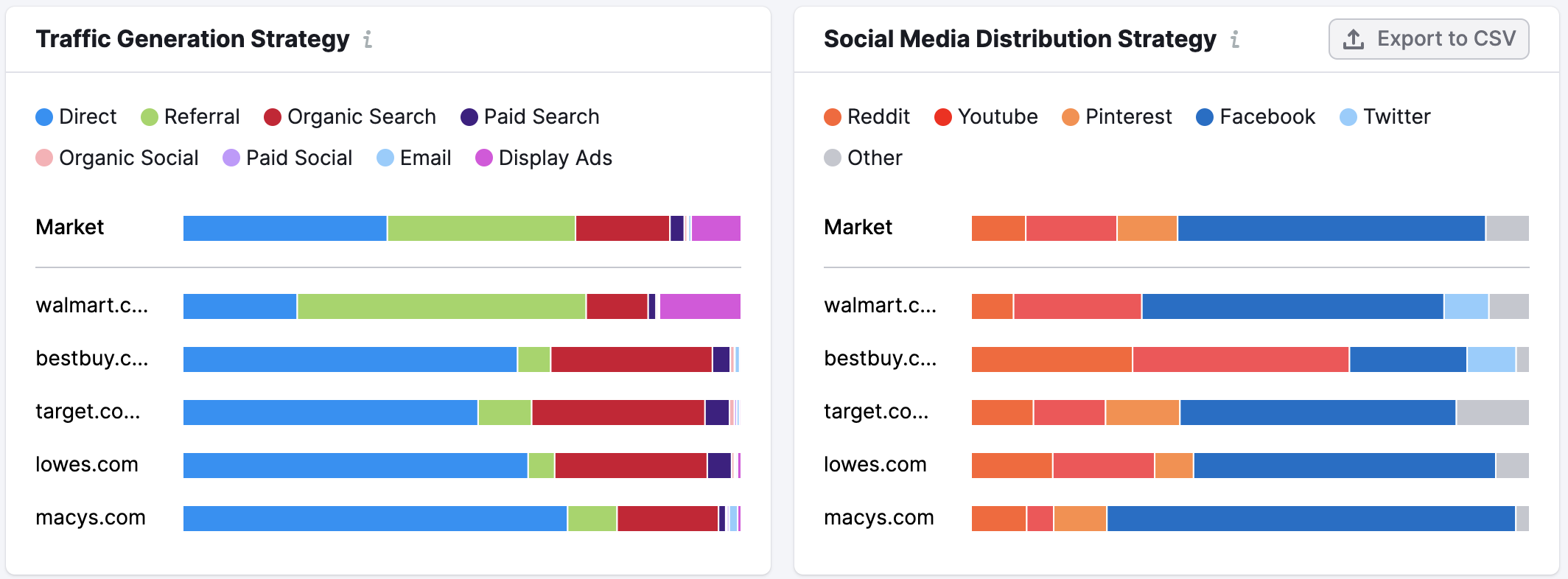

You can also turn to the Traffic Generation Strategy and Social Media Distribution Strategy graphs for insights into the strategies market players use to drive traffic.

These graphs show the percentage of market traffic coming from each traffic channel and each of several major social media platforms.

Looking at each graph can reveal valuable market trends, while also uncovering the strategies top players use to drive traffic.

For example, Facebook is the most popular social platform across the market, though ulta.com prioritizes Youtube. This is significant in light of the growth trend we uncovered in the previous graph.

5. Understand the market’s audiences

Finally, let’s turn to the One2Target tool to get a better grasp on the market’s audience. Here, your goal is to understand the various audience segments in the market, which can help you make decisions about product positioning and audience targeting once you decide to enter a new market.

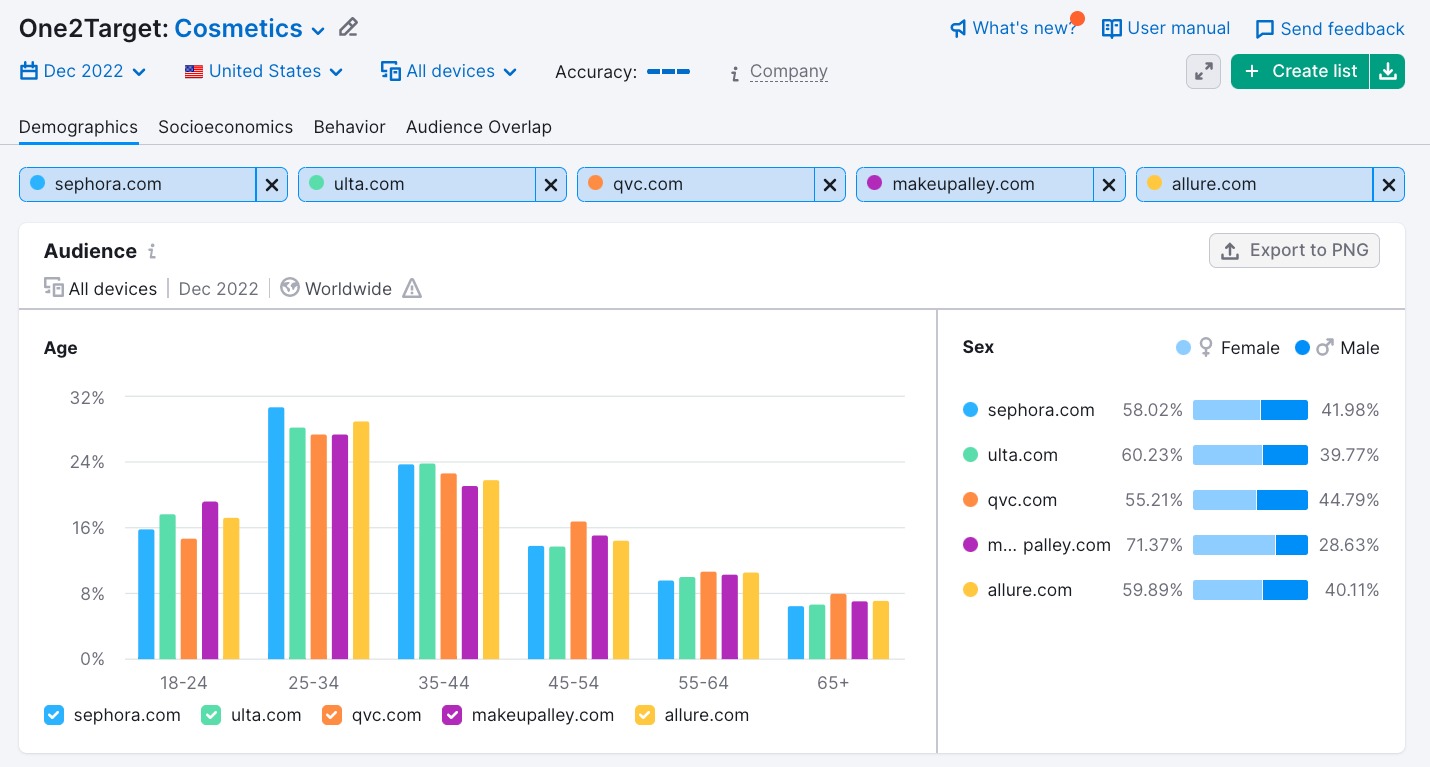

After selecting the example Cosmetics market or entering individual players into the tool to define the market, you can begin with the Demographics Report. Among other data points, you’ll discover the Audience Age & Sex breakdown.

The Cosmetics market appears to sway heavily toward females between the ages of 25-34. Though there are other significant segments, such as the 35-44 age range. Likewise, qvc.com seems to have a higher than average male audience.

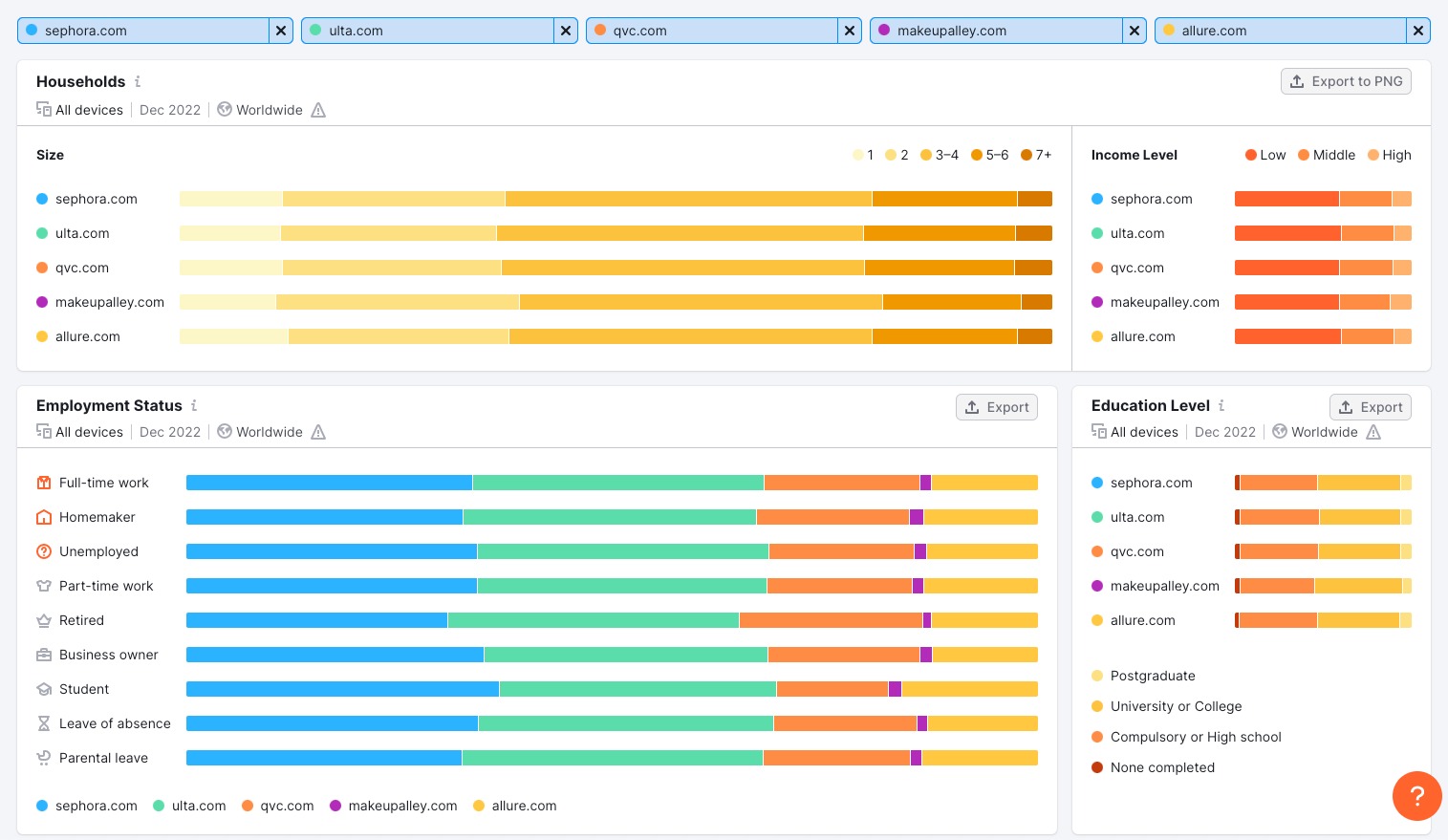

The Socioeconomics Report can tell you a great deal about the audience’s household, income, education, and employment statuses. With this data, you can better understand who makes up the audiences.

For example, looking at the Employment Status graph, we can see that Allure has a higher than average number of students in their audience. If you wanted to attract this segment to your business, you might look more closely at Allure’s offerings and marketing.

As you seek to enter a new market, it’s crucial to understand the audience you’re going to be engaging, and this data can help approach them most effectively.

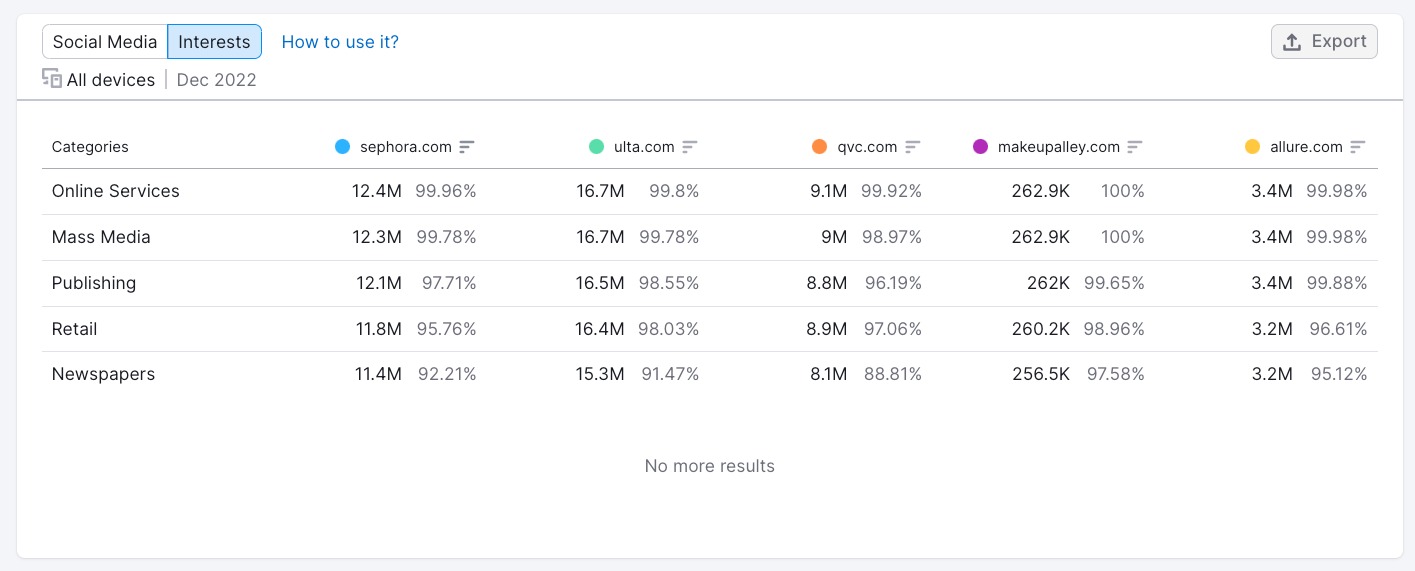

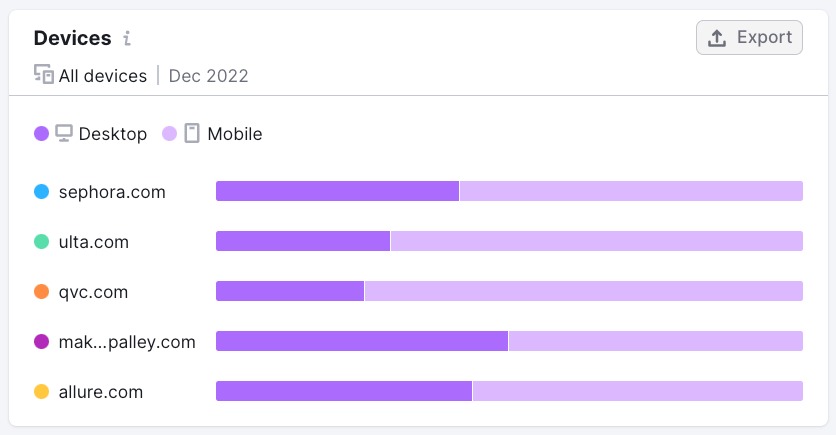

Finally, the Behavior Report offers insights into Audience Interests and Device Preferences.

Both of these audience behavior metrics will come in handy as you look to effectively connect with market audiences.

For example, knowing that the market audience enjoys Mass Media and Publishing can provide ideas about ad placements and understanding that most audience members prefer to use mobile phones can help you think about marketing design elements.