VAT FAQ

Value Added Tax (VAT) in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It applies to most goods and services that are bought and sold for use or consumption in the European Union.

Semrush collects Value Added Tax (VAT) for customers residing within the European Union, UK, The Isle of Man, Monaco, Norway, Switzerland, Turkey, South Africa, Mexico, Vietnam, and the United Arab Emirates (UAE)

According to EU VAT regulations enforced at the beginning of 2015, the Semrush Corporation is obliged to collect VAT on payments of customers consuming our service within the European Union.

When ordering a new Semrush subscription, you will be asked to confirm whether or not you are inside the EU for VAT purposes. If you confirm that you are outside of the European Union for VAT purposes, VAT will not apply.

If you are within the European Union for VAT purposes, you should take the following details into account:

- If you consume our service, being a legal entity (B2B), and provide us with your valid VAT number, VAT will not be applied to your payment.

- If you consume our service, being a legal entity (B2B), and your VAT number is not valid, VAT will be applied at the appropriate rate of your country of residence. To avoid this, please make sure that:

- Your VAT number is entered correctly, including your country number; and is valid.

- You are not using your personal (individual) VAT number.

- If you consume our service, being a legal entity (B2B), and we are unable to verify the VAT number you entered, your payment will be processed and VAT charged. We will try to verify it again later.

- If you consume our service, being an individual (B2C), VAT will be applied at the appropriate rate of your country of residence.

For users who have purchased a Semrush recurring subscription or who began using the automatic API-billing feature before 2015: VAT has already been applied at the appropriate rate of the country indicated by your invoice information on your User Profile.

Also, if you update your Profile by entering a new VAT number or another country or state of residence, the cost of your recurring subscription may change according to possible differences in your VAT rate.

For example, if a customer completes an order for a recurring subscription and confirms that he/she is outside the EU, and then later confirms that he/she is a EU resident via the Profile form, VAT will be charged with the next payment.

Or, if a customer completes an order for a recurring subscription and confirms that he/she consumes Semrush services in Cyprus, a VAT rate of 19% applies. If Greece is selected as a country of consumption, a VAT rate of 24% will apply.

If you have a recurring subscription, and you change your billing information when paying for other Semrush products, such as a custom report or API, VAT will be applied to your recurring subscription with the next payment.

Semrush also collects Value Added Tax (VAT) for customers residing within the UK, The Isle of Man, Monaco, Norway, Switzerland, Turkey, South Africa, Mexico, Vietnam, and the United Arab Emirates (UAE).

If you are within one of these countries for VAT purposes, you should take the following details into account:

- If you consume our service, being a legal entity (B2B), and provide us with your valid VAT number, VAT will not be applied to your payment.*

- If you consume our service, being a legal entity (B2B), and your VAT number is not valid, VAT will be applied at the appropriate rate of your country of residence. To avoid this, please make sure that:

- Your VAT number is valid and is entered correctly, including your country code when applicable. You can find the exact VAT format requirements for each country below.

- You are not using your personal (individual) VAT number.*

- If you consume our service, being a legal entity (B2B), and we are unable to verify the VAT number you entered, your payment will be processed and VAT charged. We will try to verify it again later.

- If you consume our service, being an individual (B2C), VAT will be applied at the appropriate rate of your country of residence.

*Please note that Switzerland, Mexico, and South Africa are exceptions as we are obliged to collect VAT from all payments of users in these countries regardless of whether they are B2B or B2C.

If you update your User Profile by entering a new VAT number or another country or state of residence, the cost of your recurring subscription may change according to possible differences in your VAT rate.

For example, if a customer completes an order for a recurring subscription and confirms that he/she is outside the UK, and then later confirms that he/she is a UK resident via the Profile form, VAT will be charged with the next payment.

If you have a recurring subscription and you change your billing information when paying for other Semrush products, such as a custom report or an API package, VAT will be applied to your recurring subscription with the next payment.

EU Countries

Austria

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: AT + 9 characters

Note: the first character (before the Country code ‘AT’) is always a ‘U’

Format Example: ATU12345678

Belgium

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: BE + 10 characters

Note: prefix with zero ‘0’ if your Business number is 9 digits instead of 10

Format Example: BE0123456789

Bulgaria

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: BG + 9 or 10 characters

Format Examples: BG123456789 or BG1234567890

Croatia

- VAT rate we collect is 25%

- VAT number format to be added to your Billing Info page: HR + 11 characters

Format Example: HR12345678901

Cyprus

- VAT rate we collect is 19%

- VAT number format to be added to your Billing Info page: CY + 9 characters

Note: the last character must always be a letter Format Example: CY12345678X

Czech Republic

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: CZ + 8, 9, or 10 characters

Note: if your Business number is more than 10 characters delete the first 3

Format Examples: CZ12345678, CZ123456789 or CZ1234567890

Denmark

- VAT rate we collect is 25%

- VAT number format to be added to your Billing Info page: DK + 8 characters

Format Example: DK12345678

Estonia

- VAT rate we collect is 22%

- VAT number format to be added to your Billing Info page: EE + 9 characters

Format Example: EE123456789

Finland

- VAT rate we collect is 25.5%

- VAT number format to be added to your Billing Info page: FI + 8 characters Format

Example: FI12345678

France

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: FR + 11 characters

Note: Business number may include alphabetical characters (any except O or I) as first or second or first and second characters.

Format Example: FR12345678901 or FRX1234567890 or FR1X123456789 or FRXX123456789

Germany

- VAT rate we collect is 19%

- VAT number format to be added to your Billing Info page: DE + 9 characters

Format Example: DE123456789

Greece

- VAT rate we collect is 24%

- VAT number format to be added to your Billing Info page: EL + 9 characters

Format Example: EL123456789

Hungary

- VAT rate we collect is 27%

- VAT number format to be added to your Billing Info page: HU + 8 characters

Format Example: HU12345678

Ireland

- VAT rate we collect is 23%

- VAT number format to be added to your Billing Info page: IE + 8 or 9 characters

Note: Business number includes one or two alphabetical characters (last, or second and last, or last 2)

Format Example: IE1234567WA

Italy

- VAT rate we collect is 22%

- VAT number format to be added to your Billing Info page: IT + 11 characters

Format Example: IT12345678901

Latvia

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: LV + 11 characters

Format Example: LV12345678901

Lithuania

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: LT + 9 or 12 characters

Format Examples: LT123456789 or LT123456789012

Luxembourg

- VAT rate we collect is 17%

- VAT number format to be added to your Billing Info page: LU + 8 characters

Format Example: LU12345678

Malta

- VAT rate we collect is 18%

- VAT number format to be added to your Billing Info page: MT + 8 characters

Format Example: MT12345678

Netherlands

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: NL + 12 characters

Note: The 10th character in a Business number is always B, and companies forming a VAT Group have the suffix BO2

Format Examples: NL123456789B01 or NL123456789BO2

Poland

- VAT rate we collect is 23%

- VAT number format to be added to your Billing Info page: PL + 10 characters

Format Example: PL1234567890

Portugal

- VAT rate we collect is 23%

- VAT number format to be added to your Billing Info page: PT + 9 characters

Format Example: PT123456789

Romania

- VAT rate we collect is 19%

- VAT number format to be added to your Billing Info page: RO + up to 10 digits (2 digits minimum)

Format Example: RO1234567890

Slovakia

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: SK + 10 characters

Format Example: SK1234567890

Slovenia

- VAT rate we collect is 22%

- VAT number format to be added to your Billing Info page: SI + 8 characters

Format Example: SI12345678

Spain

- VAT rate we collect is 21%

- VAT number format to be added to your Billing Info page: ES + 9 characters

Note: Business number includes 1 or 2 alphabetical characters (first or last or first and last)

Format Examples: ESX12345678, ES12345678X, ESX1234567X

Sweden

- VAT rate we collect is 25%

- VAT number format to be added to your Billing Info page: SE + 12 characters

Format Example: SE123456789012

Non-EU Countries

Mexico

- VAT rate we collect is 16%

- VAT number name - RFC number

- RFC number format to be added to your Billing Info page: 12 symbols with the following structure: xxxyyyyyyzzz (x = letters, y = numbers, z = alphanumeric)

or 13 symbols with structure: xxxxyyyyyyzzz (x = letters, y = numbers, z = alphanumeric).

Format Examples: ABC010203AB9 (for RFC number with 12 symbols) and ABCD010203AB9 (for RFC number with 13 symbols).

Monaco

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: FR + 11 characters

Format Example: FR12345678901

Norway

- VAT rate we collect is 25%

- VAT number format to be added to your Billing Info page: 9 digits or 9 digits + MVA

Format Example: 123456789 or 123456789MVA

South Africa

Note: Even if a valid VAT number is provided to us, we are still obligated to collect VAT from customers in South Africa. You can find more information here.

- VAT rate we collect is 15%

- VAT number format to be added to your Billing Info page: 10 digits

Note: Business number should start with 4

Format Example: 4123456789

Switzerland

Note: Even if a valid VAT number is provided to us, we are still obligated to collect VAT from customers in Switzerland. You can find more information here.

- VAT rate we collect is 8.1%

- VAT number format to be added to your Billing Info page: CHE + 9 characters + MWST/TVA/IVA(optional)

Format Examples: CHE123456789 or CHE123.456.789 or CHE123.345.678MWST or CHE123.345.678TVA or CHE123.345.678IVA

The Isle of Man

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: GB + 9 or 12 digits

Format Example: GB123456789

Turkey

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: 10 digits

Format Example: 0123456789

United Arab Emirates

- VAT rate we collect is 5%

- VAT number format to be added to your Billing Info page: 15 digits

Format Example: 123456789123456

United Kingdom

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page: GB + 9 or 12 digits

Format Example: GB123456789

United Kingdom (Northern Ireland)

- VAT rate we collect is 20%

- VAT number format to be added to your Billing Info page:

XI + 9 digits

XI + 12 digits (branch traders)

XI + 5 characters (Government Departments and Health Authorities)

Format Examples: XI123456789 or XI123456789123 or XIGD123 or XIHA123

Vietnam

Note: We collect VAT only from B2C (customers who don’t have a valid VAT number) and not from B2B (customers who do have a valid VAT number).

- VAT rate we collect is 5%

- Tax code (VAT) format to be added to your Billing Info page: 10 or 13 digits

Format Example: 1234567890 or 1234567890123

Frequently Asked Questions

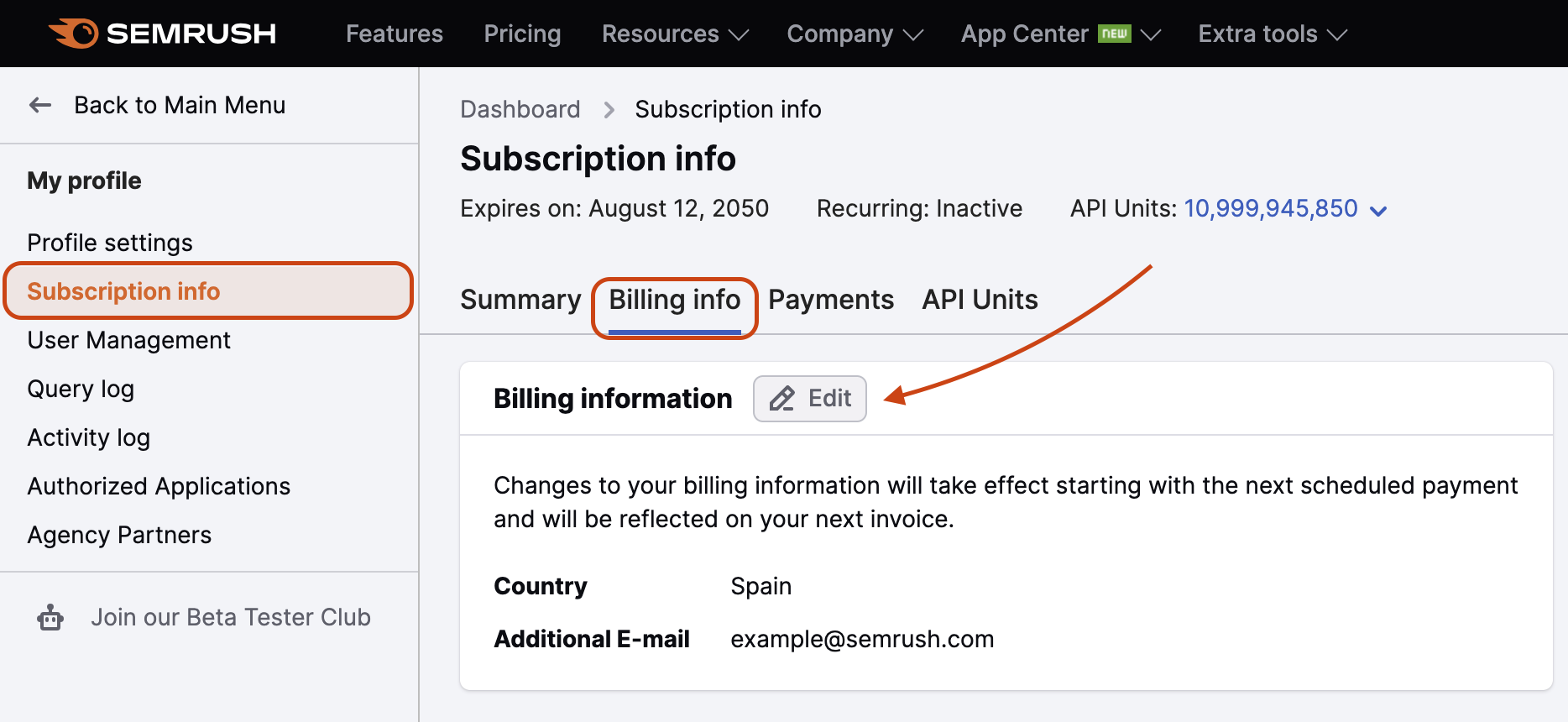

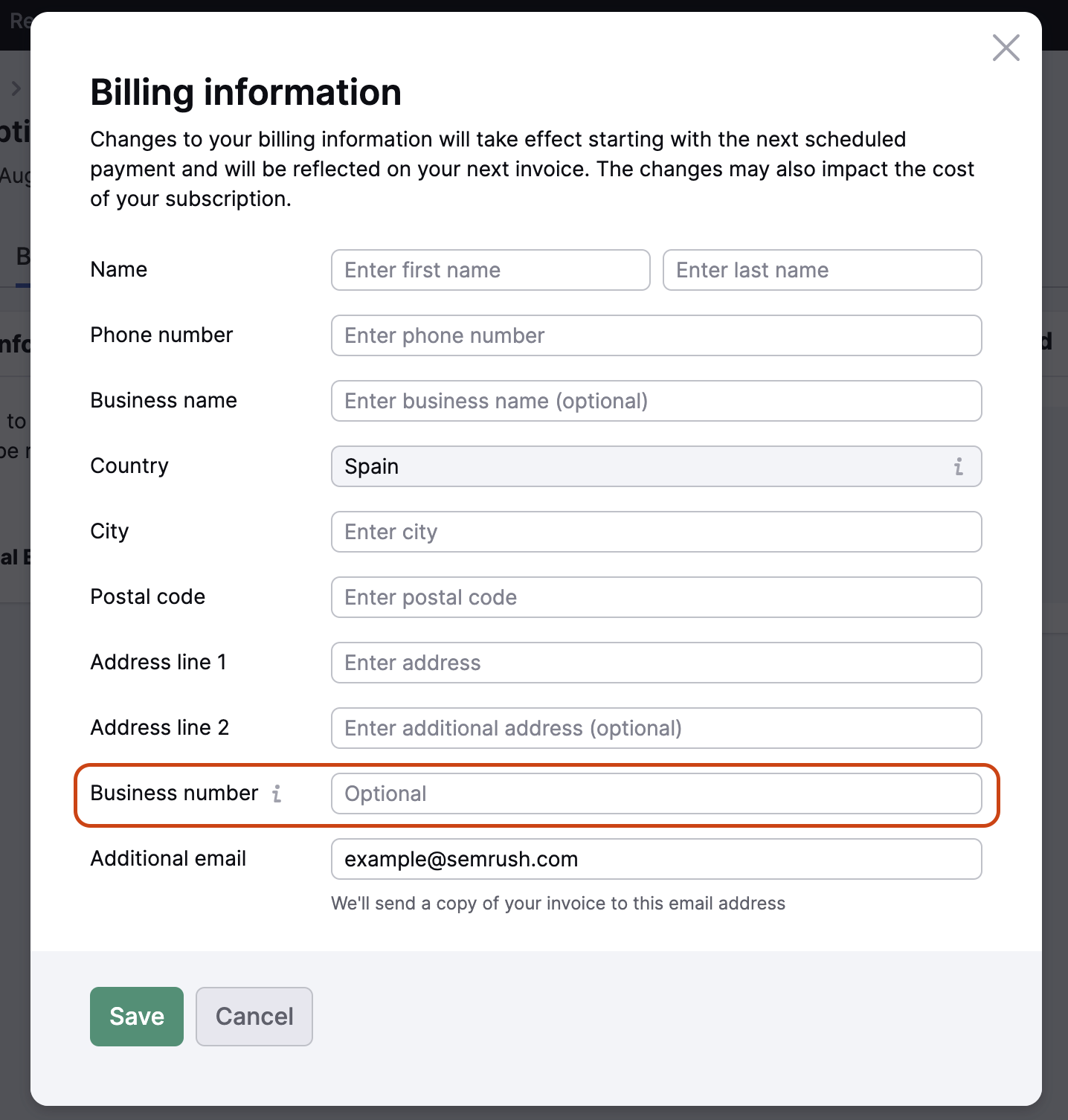

You can add your VAT/GST number in the Subscription Info section of your User Profile. To do this, please follow these steps:

- Sign in your Semrush account.

- Under My Profile, choose Subscription Info, then navigate to the Billing info tab.

- Under Billing info, choose to edit your Billing info and enter the number in the Business number field.

- Enter your number and click Save.

When you add a VAT number, use a country code at the beginning.

Note: for Norway, a country code is not applicable, you need to enter a VAT number without a country code (only 9 digits or 9 digits and the letters ‘MVA’).

If you forgot to enter your VAT/GST, you can add it to your profile later at any time. If you add it before the next recurring payment, Semrush will not charge VAT on the next invoice or future invoices issued to you, as long as the number is valid.

If you add a valid VAT number and VAT has previously been charged on your account, please reach out to our Customer Support team regarding the taxes paid.

Please note: all customers from Switzerland and South Africa continue paying VAT even if their provided VAT number is valid.

Kindly be advised that this page serves as a reference tool exclusively. Though regularly revised, it should not be interpreted as an exhaustive and authoritative compilation of all relevant VAT rates. We strongly urge users to reach out to official representatives of the respective country or territory to obtain the most accurate and up-to-date information on applicable rates.